The Education Technology (EdTech) Industry: Overview of Mergers, Acquisitions and Venture Capital Trends & Investments

Introduction

Education technology (EdTech) is a term used to describe the industry that combines education and technological advances, revolutionizing the conventional landscape of education. EdTech not only allows educational institutions to serve a larger and more diverse audience, but also enables educational participants, both teachers and students, to foster relationships in an interactive fashion. Students (K-12) participating in schools with technological integration efforts achieved an increase of 94 points on average in SAT I performance[1]. With computers and software-assisted tools, students in a Pittsburgh tutoring program outperformed the comparison classes by 15%[2]. Students in the National Assessment of Educational Progress (NAEP) also demonstrated an enhancement in higher-order thinking and the ability to solve mathematical problems, regardless of the classroom size[3]. EdTech not only affects student learning but also teacher administration. For instance, there was an increase in the teaching of online courses from 30% in 2016 to 42% in 2017. In addition, online collaboration has shown an overall reduction by 20% in disciplinary actions and dropout rates[4]. Nearly one-third of the faculty in the research agreed that online courses can achieve learning outcomes, compared to traditional classroom teaching[5]. It is evident that technology has unlocked the power of education beyond imagination. With the recent high pace of advancement in technology EdTech it starting to discover its potential and will continue to rapidly develop in the near future. According to Holon IQ, the global education market has reached a value of over $6 trillion with only $150 billion of market capitalization. Even though digitization only occupies 2.6% of the total educational expenditures as of 2018, indicating $152 billion of EdTech expenditures, digital spend is expected to increase to a $342 billion scale, taking 4.4% of total educational expenditures by 2025[6]. There are a few major segments within the EdTech realm, including early childhood, K-12, higher education and lifelong learning. The K-12 software platform and tools market is the dominant segment within the EdTech industry. This portion of the K-12 market had a market value of $1.71 billion in 2018 in the U.S., and is expected to be worth more than $1.83 billion by 2020[7]. Compared to other segments within the U.S., K-12 has occupied 46% of the EdTech market while higher education and lifelong learning together occupy the other 54%. Even though K-12 is the dominant force, the percentage of market share is expected to remain steady for the next three years[8]. A discussion on technological advances wouldn’t be complete without a discussion of virtual reality. It is significant that virtual reality (VR) has become more noticeable and accessible to consumers, benefiting visual learners and promoting interactive teaching methods. VR breaks through the traditional physical constraints, accessing information through visual representations, audio, and virtual interactions. Google has developed an app, Google Expeditions, where participants are able to explore many parts of our Earth, making geological field studies more cost-efficient and flexible. They also have developed Daydream Labs where employees can be trained visually and interactively, resulting in a faster learning process[9]. The benefits of VR are not limited to language immersion, architecture, interior design, space expedition, biology, chemistry or pharmaceutical practices. Any traditional interactions with textbooks and humans can be visualized and customized into VR[10]. The combination of education and technology has truly altered the space of teaching, developing knowledge and gaining expertise. A bright future of EdTech awaits.

Industry Overview

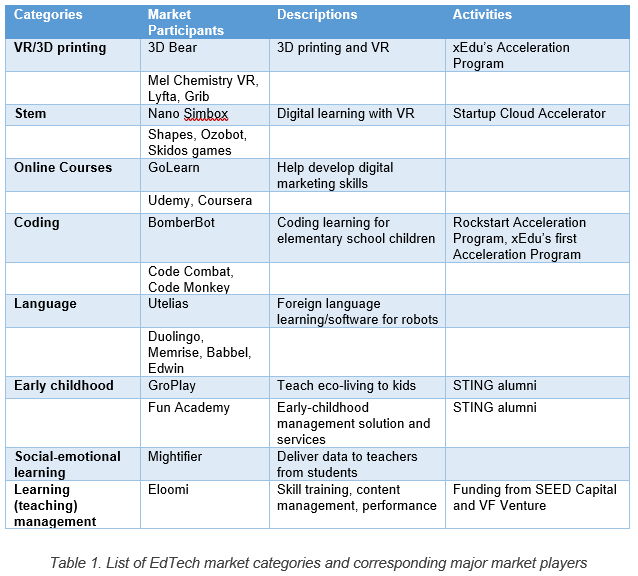

Education is communication and EdTech enables communication to reach deeper and wider audiences. EdTech has enriched education, reaching various industrial categories such as coding, language, Science, Technology, Engineering, Math (STEM), social-emotional learning, early childhood education and learning management tools. The emergence of Virtual Reality (VR) has also enhanced educational activities, enabling them to become more interactive. There are a few major players in each market category highlighted in the following table. The main consumers in EdTech include K-12 and other students who participate in the educational programs, as well as higher educational institutions and corporations that develop EdTech products.

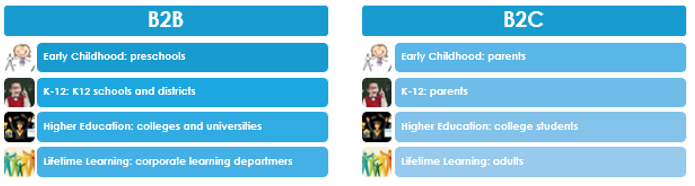

The future of EdTech is promising within the U.S. The education technology market size has been expanding at rates ranging from 8.3% to 9.28%. Some projections place the market at nearly $43 billion by the end of 2019 compared to $39.33 billion in 2018. The educational service industry has also been catching up with the global pace[11]. There was $18.1 billion of revenue in the fourth quarter of 2018 in the educational support segment, indicating a 0.9% increase from the last quarter and more than 7% increase compared to the same period last year[12]. Furthermore, funding seems promising on a global scale. With 813 new EdTech companies funded in 2017, the market projects 17% growth in the EdTech industry reaching $250 billion of market investment by 2020[13]. Geographically, 58% of funds were sourced from the United States with $5.5 billion of investments, 18.6% from China with $1.7 billion, followed by India with $397 million and mostly European countries contributing the balance. A sustainable business model and profit results are major factors in investment decisions. In general, the basic models can be summarized as business-to-business (B2B), business-to-consumer (B2C) and direct product or service-based business models. B2B includes the most diverse business models in the EdTech realm. This includes offering products to schools (a B2B2C model) and offering bundles to distribution channels. An example of these models is TeachBoost, a solution that utilizes the B2B2C model to offer free services or premium services with extra charge to schools. Clever and LearnSprout are also good examples of being the middlemen between schools and start-up EdTech companies, offering development easement while collecting valuable data from educational institutions. B2C, however, includes some variability, such as “freemium” models for teachers, direct services to students, or even offering the product directly to parents. MasteryConnect offers a freemium model to teachers with additional fees for premium services. ABCya! offers free educational video game services in order to promote their own website and other paid iOS applications. Finally, third-party offerings provide various kinds of solutions, mostly suitable for one or a few EdTech entities since they are individually crafted. One general example would be Panorama Education. They offer comprehensive products and administrative services directly to districts[14]. Other business models found in the EdTech space include Business Model Canvas (BMC), Cost-revenue Model[15] and Sensavis’ Value Network that focuses on value adding[16].

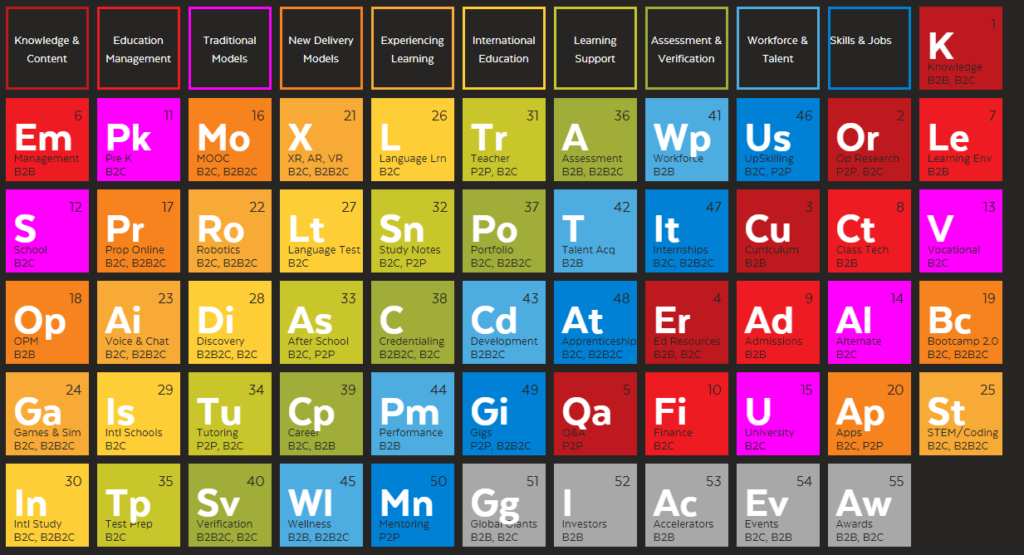

[17] Additionally, there are 55 categories of future education, illustrated in an open-source taxonomy.

[18] Xucong “Rex” Liang contributed to this report. Sources [1] Bain, A., & Ross, K. (1999). School reengineering and SAT-I performance: A case study. International Journal of Education Reform, 9(2), 148–153. http://educ116eff11.pbworks.com/w/file/fetch/44935610/Article.StudentLearning.pdf. P47 [2] Koedinger, K., Anderson, J., Hadley, W., & Mark, M. (1999). Intelligent tutoring goes to school in the big city. [Online]. Pittsburgh, PA: Carnegie Mellon University. Available: http:// act.psy.cmu.edu/awpt/AlgebraPacket/kenPaper/paper.html. P1 [3] Valdez, G., McNabb, M., Foertsch, M., Anderson, M., Hawkes, M., & Raack, L. (1999). Computer-based technology and learning: Evolving uses and expectations. Oak Brook, IL: North Central Regional Educational Laboratory. http://educ116eff11.pbworks.com/w/file/fetch/44935610/Article.StudentLearning.pdf. P48 [4] https://www.k12blueprint.com/toolkits/personalized-learning [5] https://www.educationdive.com/news/survey-more-faculty-gradually-warm-to-online-courses/508505/ [6] https://www.holoniq.com/edtech/10-charts-that-explain-the-global-education-technology-market/ [7] https://marketbrief.edweek.org/marketplace-k-12/k-12-ed-tech-platform-tools-market-value-increase-1-83-billion-2020-report-says/ [8] EdTech US Market Snapshot, Australia Unlimited. https://www.austrade.gov.au/ArticleDocuments/5085/Edtech-US-market-snapshot.pdf.aspx/ [9] https://www.opencolleges.edu.au/informed/edtech-integration/10-ways-virtual-reality-already-used-education/ [10] https://theblog.adobe.com/virtual-reality-will-change-learn-teach/ [11] EdTech US Market Snapshot, Australia Unlimited. https://www.austrade.gov.au/ArticleDocuments/5085/Edtech-US-market-snapshot.pdf.aspx/ [12] https://www.census.gov/services/qss/qss-current.pdf [13] https://www.prnewswire.com/news-releases/global-report-predicts-edtech-spend-to-reach-252bn-by-2020-580765301.html [14] https://edtechhandbook.com/business-models/overview-of-edtech-business-models/ [15] https://www.academia.edu/37460238/Defining_Optimized_Business_Models_of_Online_Education_Platforms_in_the_EdTech_Market_Eng_ [16] https://www.researchgate.net/publication/322291404_Business_Model_Innovation_in_Edtech_-_An_exploratory_study_of_business_model_innovation_in_a_complex_market_environment [17] http://www.blended.blog/eight-buckets-of-edtech/ [18] https://globallearninglandscape.org/

EdTech Investment Trends

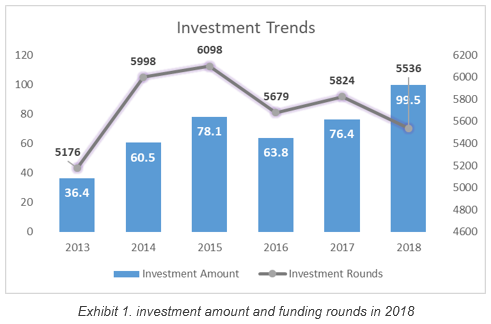

The funding trends have turned in an unexpected way in 2018 within the U.S. market. In 2013 only $36.4 billion was funded in the industry with 5,176 funding rounds closed. The amount funded increased more than a fold to $78.1 billion and the number of rounds closed increased by 17.8% to 6,078 in 2015. Regardless of the overall increase in funding of 27.4% to $99.5 billion between 2013 and 2015, there had been decreases in round closings, from 6,098 to 5,536 in 2018.[1]

It indicates that, regardless of the new emergence of the EdTech industry in the early years, there has been a trend of fewer funding events but with larger amount per event. In addition, the U.S. EdTech funding environment has gravitated towards larger dollar amounts. Throughout most of the quarters in the past 2 years, the number of U.S. funding rounds for funding over $100M had surpassed Asia by 5 to 8. Also, surprisingly, the mega U.S. funding rounds (over $1B) had surpassed the Asian market by 13 rounds.[1]

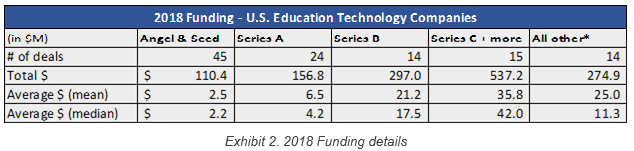

To take a deeper look at the funding landscape in 2018, Series C and lower grades had occupied more than 39% of the funding market at $537.2M while Angel & Seed occupied more than 40% of the funding deals at 45 rounds.[2]

In 2018, post-secondary and higher education were enjoying over 35% of the funding raised by U.S. EdTech companies, with about a fold in percentage increase. The reason for such surprising growth is the need to close the gap between college and employment. With high levels of student loan debt, this demand has become more urgent. Thus, companies like Trilogy Education that raised $50 million offers short-term workforce training to validate students’ skills before being employed.

Companies like Handshake that raised $40 million provides an online platform that connects students with employers. Guild Education supports the business with affordable employee development and educational programs by offering connections with universities. Other corporations such as Chipotle and Walmart who support front-line employees to get college degrees are also supported by Guild Education, which raised $40 million in 2018. Overall, post-secondary and higher education are becoming more popular among both the employment market and the EdTech industry.

K-12 is facing a challenge, however, that with strong and successful market penetration, the product licenses purchased by school districts might not be actually used by students.[3] According to research conducted by LearnTrials, 65% of the licenses purchased were rarely used by students.[4] With such information available to investors, there could be a slight drop in the number of investors in the K-12 sector.

To take a deeper look, there are a few major investment participants in the EdTech industry that has raised a noticeable amount in their history. For instance, HotChalk, a company that supports universities in consulting work and promotes degrees online, has raised $235 million. Coursera, a well-known company that offers Massive Open Online Courses to 20 million students and partners with 140 universities, has raised $235 million. Udacity provides self-study learning materials and has raised over $160 million. Not to mention the famous Age of Learning, General Assembly and Duolingo, that present textbook examples of success in the EdTech space.[5]

On the other hand, fast-growing industries usually phase into clusters as they mature, and EdTech is not an exception. As an example, San Francisco has become the state with the largest technology, over $6 billion [6], and a great amount of EdTech funding deals, 463 within 5 years since 2011 [7]. Some major firms located in the Bay Area or Silicon Valley include Udemy, Udacity, and HotChalk. New York and Washington both have an abundant amount of K-12 schools and higher educational institutions. Some EdTech firms that represent these states include McGraw Hill Education, General Assembly, 2U and BlackBoard. Even not as established, EdTech has also been clustering in states of Chicago, Texas, and Utah due to their educational resources or technological incentives.[5]

Where we can help

Edtech is the representation of both innovation and growth, but it is also a realm of expertise. With our knowledge and experience, we will be able to help clients and you collaborate in your EdTech expertise, pinpoint any potential problems and seek for data-driven, research-validated solutions. We fully acknowledge your interest in the EdTech realm. For further information, please contact our licensed bankers.

Xucong “Rex” Liang contributed to this report.

Sources

[1] https://www.cbinsights.com/research/report/venture-capital-q4-2018/ [2] https://www.edsurge.com/news/2019-01-15-us-edtech-investments-peak-again-with-1-45-billion-raised-in-2018 [3] https://www.edsurge.com/news/2018-11-08-why-aren-t-schools-using-the-apps-they-pay-for [4] http://www.educationaldatamining.org/EDM2016/posters/poster-203.pdf [5] EdTech US Market Snapshot, Australia Unlimited. https://www.austrade.gov.au/ArticleDocuments/5085/Edtech-US-market-snapshot.pdf.aspx/ [6] San Francisco Center for Economic Development, Venture Capital Research Report Q1 2017, viewed June 2019, <http://sfced.org/wp-content/uploads/2017/06/VC-Report-Q1-2017-Final-6.22.2017.pdf>. [7] CB Insights, Ed Tech Goes Global: India Sees Deals Explode While China Takes One-Fifth Of Funding, April 2016, viewed June 2019, <https://www.cbinsights.com/research/edtech-dealsgeographic-trends-2016/#head3>.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021